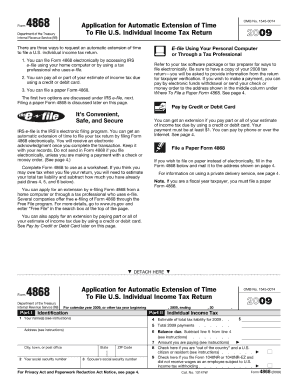

Individual Income Tax Return Who Can File Form 4868? Form 4868 - Application for Automatic Extension of Time To File U.S. It is important to remember that you make all tax payments by the tax deadline date, or you may accrue interest and penalties as Form 4868 does not allow late payments.

It is mandatory to send in the owed amount by the deadline. The IRS can grant an extension only for paperwork. It's an Internal Revenue Service (IRS) form that allows individuals to extend the time they have to complete their tax returns. citizens and residents applying for an extension of time to file a tax return use Form 4868. The IRS Form 4868 is the Application for Automatic Extension of Time to File Individual Income Tax returns. What Is Form 4868 - Application for Automatic Extension of Time To File U.S. Information Necessary to E-file Form 4868.What Is Form 4868 - Application for Automatic Extension of Time To File U.S.

This post explores what IRS form 4868 is all about and how you can use it to get an extension. With IRS form 4868, you can easily sail through such times as it allows you to buy some more time to file your returns. Failing to do so in time usually results in a penalty or a fine. You must still pay on the tax deadline date as tax deadlines remain unchanged, and late payments are subject to interest and penalties.Īlso, there are deadlines for filing the returns. Form 4868 is a form that enables you to file for an extended period to file your 1040 form.įiling Form 4868 does not imply you receive permission for late payments of taxes owed. Situations and reasons may vary but circumstances like these are not completely unavoidable. There are times when you as a taxpayer need more time to file your tax returns.

0 kommentar(er)

0 kommentar(er)